Credit cards have revolutionized the way we conduct commerce in modern-day America. The advent of credit cards has not only provided convenience and flexibility but has also played a significant role in shaping the entire landscape of commerce.

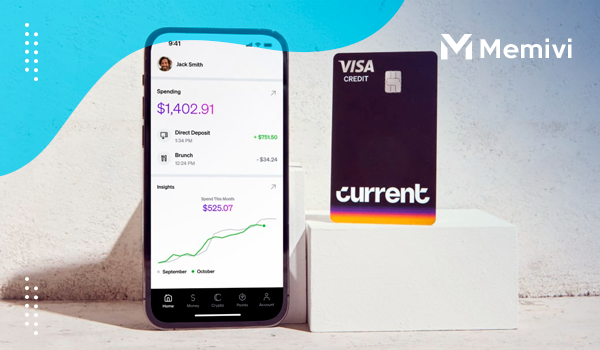

The Current Build Card is a revolutionary financial tool that is designed to provide users with an enhanced banking experience. This innovative product is specifically tailored for the needs of the modern individual, offering a seamless and convenient way to manage finances.

So, what exactly is the Current Build Card? Simply put, the Current Build Card is a prepaid debit card that comes with a range of unique features and benefits. It allows users to easily access their money, make purchases online and in-person, and even withdraw cash from ATMs. But what sets it apart from traditional debit cards is the comprehensive suite of tools and resources that come along with it.

Benefits of Current Build Card

- No annual fee

One of the standout features of the Current Build Card is the absence of any annual fee. Unlike many credit cards that burden you with additional charges, this card allows you to enjoy its perks without worrying about recurring costs.

- No credit check

For individuals with less-than-perfect credit scores, obtaining a credit card can be a challenge. With the Current Build Card, however, there is no need for a credit check, making it accessible to a wider range of individuals who may have struggled to secure credit in the past.

- No APR

The Current Build Card stands apart from traditional credit cards by eliminating the concept of APR (Annual Percentage Rate). Say goodbye to interest charges and hidden fees, allowing you to manage your finances without the stress of accumulating debt.

- Adjustable credit limit

Flexibility is key in today’s ever-changing financial landscape. The Current Build Card offers an adjustable credit limit, enabling you to tailor your spending power to your specific needs. Whether you’re looking for a higher limit for large purchases or a lower limit for more controlled spending, this feature puts you in control.

- Allows you to earn rewards

Who doesn’t love earning rewards while making everyday purchases? With the Current Build Card, you can unlock exciting rewards with every swipe. From cashback offers to exclusive discounts and loyalty incentives, this card provides a fantastic opportunity to maximize your benefits and save money. Rewards rates will vary from 1x to 7x points on in-store or online purchases, depending on the merchants.

- Fee-free Overdraft

Building credit can be challenging, but the Current Build Card makes it easier by offering a secured card with no overdraft fees. Unlike most cards, Current provides a fee-free experience in every aspect, including overdraft fees. Simply set up and receive a qualifying direct deposit to enjoy fee-free overdraft protection.

- No Minimum Deposit Required

Forget the traditional secured credit cards that demand hefty deposits. The Current Build Card revolutionizes banking by requiring no minimum deposit to open a credit account. Just open a Current account, transfer funds to become your security deposit, and set your credit limit. It’s that simple and accessible!

- Build Credit Safely

Enhancing your credit score has never been more straightforward. The Current Build Card not only reports all transactions to credit bureaus but also allows you to use your card at any Visa-accepting location, including ATMs, to boost your credit score. Every swipe counts towards building your credit!

- Control Your Budget

Current offers a unique budgeting feature, allowing you to set up budget categories with spending limits. Current tracks your spending in each category and alerts you when you’re close to your limit, helping you manage your finances efficiently and stay within your budget.

- Paycheck Advance

Need your paycheck early? The Current Build Card offers a Paycheck Advance program, allowing you to access your funds up to two days earlier without affecting your credit score. No credit check or fees are required for this advance, though you can opt for instant delivery for a small fee. Just set up payroll deposits to your Current account to qualify.

- Current Teen Banking

Teach your teens about finances with the Current Teen Banking account, designed for ages 13 to 17. Parents with a Current account can open a fee-free teen debit card account, complete with parental controls, notifications, chore assignments, and allowance features. It’s a great way to give your kids financial freedom while keeping their spending visible and secure.

Qualifying for Current Build Card

Minimum Credit Score needed: You can get Current Build Card by only having a poor to good credit score which means it can be between 350 to 500. Annual Income requirements: Annual income requirements are not applicable with Current Build Card.

How to apply for Current Build Card?

Signing up for the Current Build Card is a breeze, thanks to its fintech simplicity. Just follow these easy steps:

- Enter your phone number.

- Receive a download link via text from Current.

- Connect your bank account.

- Provide your Social Security number.

- Upload a copy of your driver’s license or passport.

- Submit your request.

It’s that straightforward to start building your credit with the Current Build Card!

FAQs about Current Build Card

Are there any fees associated with the Current Build Card?

Yes, some fees like foreign transaction and late payment fees may apply. For a detailed list, please refer to Current’s official website.

How does the credit reporting work with Current Build Card?

The card reports to TransUnion and plans to include other major credit bureaus soon, aiding in building a strong credit history.

Can I earn rewards with the Current Build Card?

Yes, earn points redeemable for cash back on purchases at over 14,000 participating retailers nationwide.

Is there a credit check required for the Current Build Card?

No, there’s no credit check required, making it accessible to individuals with varying credit histories.

NAB Qantas Rewards Premium Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock exclusive travel perks and earn Qantas Points on everyday purchases. Start your journey with NAB today! </p>

NAB Qantas Rewards Premium Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock exclusive travel perks and earn Qantas Points on everyday purchases. Start your journey with NAB today! </p>  First Digital NextGen Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock a world of convenience and financial freedom. No credit checks and instant approval await you! </p>

First Digital NextGen Mastercard Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock a world of convenience and financial freedom. No credit checks and instant approval await you! </p>  Amazon Prime Rewards Visa Signature Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock amazing rewards, cashback on every purchase, and exclusive perks. Experience more with every swipe. </p>

Amazon Prime Rewards Visa Signature Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock amazing rewards, cashback on every purchase, and exclusive perks. Experience more with every swipe. </p>