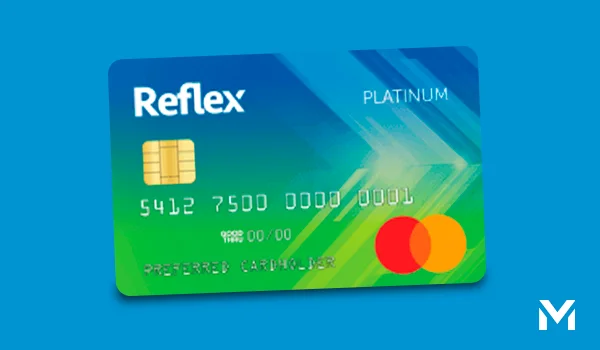

Imagine having a credit card that serves as a pathway to improving your credit profile and financial stability. This credit card is designed with a focus on credit-building, offering individuals the opportunity to establish or rebuild their credit history responsibly.

With accessible approval criteria and potential credit limit increases based on responsible use, this card provides a practical and effective solution for those seeking to strengthen their credit standing. Whether you’re new to credit or working towards improving your credit score, this card offers a valuable tool to help you achieve your financial goals.

Step into a brighter financial future, where every responsible purchase brings you closer to credit success.

Pros and Cons

Pros:

- Helps establish or rebuild credit history with responsible use.

- Demonstrated responsible use may lead to credit limit increases.

- Approval does not require a minimum credit score or credit history.

- Helps improve credit history by reporting responsible credit use to major credit bureaus.

- Widely accepted at merchants and online retailers that accept Mastercard.

Cons:

- There is an annual fee associated with this card.

- Initial credit limits might be lower compared to other cards.

For whom was this credit card made for?

This credit card is tailored for individuals who are looking to establish or rebuild their credit history. It’s ideal for those who may have limited credit history or have faced challenges in the past that impacted their creditworthiness.

The accessible approval process based on income and other factors makes this card suitable for individuals who may not qualify for traditional credit cards. Additionally, this card is designed for those seeking a straightforward credit solution without the complexity of extensive rewards programs or premium benefits.

Overall, this card serves as a practical tool for individuals aiming to improve their credit standing and build financial stability.

Why do we like this card?

We like this credit card’s credit-building opportunity and accessibility in financial tools. The potential for credit limit increases based on responsible use provides a pathway towards financial growth and flexibility.

This card reports your payment history to major credit bureaus, allowing you to improve your credit score over time with consistent on-time payments. Despite potential fees, this card offers a straightforward approach to building credit and achieving financial goals.

If you’re focused on strengthening your credit profile and prefer a credit card designed for credit-building purposes, this card could be a valuable asset in your financial journey.

Fortiva Mastercard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The Fortiva Mastercard empowers you to build credit while enjoying flexible spending options. </p>

Fortiva Mastercard Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The Fortiva Mastercard empowers you to build credit while enjoying flexible spending options. </p>  Citi Diamond Preferred Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Discover the power of simplicity: zero hassle, stellar perks, and smart solutions designed just for you! </p>

Citi Diamond Preferred Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Discover the power of simplicity: zero hassle, stellar perks, and smart solutions designed just for you! </p>  American Express Gold Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the power of rewards, dining perks, and travel benefits—your perfect companion for a luxury lifestyle! </p>

American Express Gold Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the power of rewards, dining perks, and travel benefits—your perfect companion for a luxury lifestyle! </p>