With the increasing popularity of mobile banking, Apple has taken a leap forward by introducing its own credit card – the Apple Card. This card is designed to revolutionize the way we use credit cards, with various features that set it apart from traditional credit cards.

From cashback rewards to no annual fees, there are many benefits to owning an Apple Card. But is it really worth it? In this comprehensive guide, we will take a closer look at the Apple Card, its features, and its pros and cons. We will explore the details of the application process, the interest rates and fees, and the benefits of using the Apple Card.

Overview

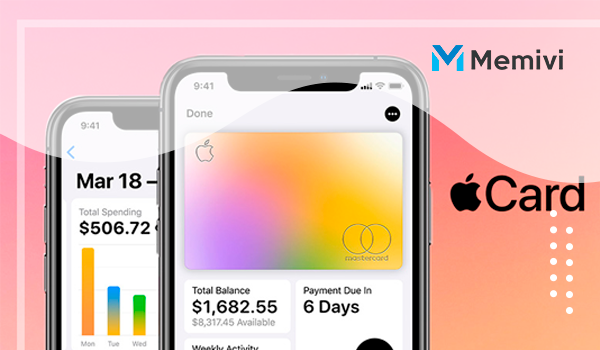

The Apple Card is a new product launched by Apple in partnership with Goldman Sachs. It is a credit card designed to be used through Apple Pay and is designed to offer a fresh and innovative approach to traditional credit card offerings. The card is designed to be used primarily through Apple Pay and presents cashback rewards on secures made through the service.

The card is also designed to be integrated with the Apple Wallet app, meaning users can track their spending, monitor their balance, and make payments all from one central location.

What Makes the Apple Card Different from Other Credit Cards?

The Apple Card is an exclusive credit card that sets itself apart from other cards in several ways.

Firstly, it is a card designed primarily for utilizing Apple Pay. This means that it can be used seamlessly with Apple Pay on all of your Apple devices, including your iPhone, iPad, Apple Watch, and MacBook. This makes it a modest and opportune option for frequent Apple users who already use Apple Pay regularly for their transactions.

In addition, the Apple Card offers a simple rewards program. Unlike other credit cards with complicated rewards structures, the Apple Card offers a straightforward cashback rewards system. Users receive 2% cashback on all purchases made with Apple Pay and 1% cashback on purchases made with the physical Apple Card.

Furthermore, there are no annual fees, late fees, or foreign transaction fees associated with the Apple Card, making it a cost-effective option for those who frequently travel abroad. Another unique feature of the Apple Card is its focus on security and privacy. The physical Apple Card does not have a visible card number, CVV, or expiration date, which makes it more difficult for fraudsters to steal your information. Additionally, all transactions are authenticated using Face ID or Touch ID, adding an extra layer of security to transactions made with the Apple Card.

Benefits of Using the Apple Card

This card offers a plethora of benefits that make it a great option for those who are looking for a new credit card.

First, the biggest benefits of consuming your balance with Apple Card is that it offers a cashback program that gives you cash back for each buying you create with the card. This cashback program is also unique in that it offers a higher percentage cashback for purchases made at select merchants, including Apple, Uber, and Walgreens.

Furthermore, Apple Card has no annual fees. Unlike many other credit cards, you won’t have to pay a fee every year just to keep your account open. This can save you a significant amount of money over time, especially if you plan to use the card for several years.

The Apple Card also provides a series of security features that are designed to keep your account safe. For example, you can use Touch ID or Face ID to log in to your account, and every time you make a purchase with the card, you’ll receive a notification on your iPhone that you can use to verify the purchase.

Downsides of Using the Apple Card

While the Apple Card may seem like an ideal credit card for Apple enthusiasts, it does have some downsides to consider before applying.

One drawback of the Apple Card is that it has a relatively high APR, ranging from 10.99% to 21.99%, depending on the creditworthiness of the user. This can add up quickly if the balance is not paid off in full each month.

Another downside is the limited acceptance of the card. While it is accepted at most merchants that accept MasterCard, it is not yet accepted everywhere, which can be frustrating for some users.

Additionally, the card does not offer any sign-up bonus or rewards for spending, other than the cashback feature for purchases made with Apple.

Lastly, Apple card’s security features, while innovative, it may not be always suitable for everyone. The requirement of utilizing Face ID or Touch ID to authenticate purchases may not be practicable for those who share their card with family members or other authorized users.

How to Apply for The Apple Card?

If you have made the decision to go for this card, the application for it is pretty straightforward. Here are the steps you need to follow to get Apple Card:

- Open the Wallet app using your iPhone or iPad.

- Tap on the Add button (+) in the top right corner of the screen.

- Select Apple Card from the list of options.

- Follow the prompts to complete your application.

- After submitting the application, a notification on your device will arrive within minutes regarding your approval status. Once approved, you may now start using your digital Apple Card instantly for online purchases.

For physical purchases, you will need to wait for your physical card to arrive in the mail. In the meantime, you can use Apple Pay to make contactless payments using your iPhone or Apple Watch.

Using the Apple Card

If you’re considering getting an Apple Card, it’s important to know how to use it properly in order to get the most benefits out of it.

- Use it with Apple Pay: Luckily, this card is designed to be used with Apple Pay, so be sure to set up using the said app on your iPhone or Apple Watch. This not only makes the checkout process faster and more convenient, but you’ll also earn more cashback when you use Apple Pay.

- Pay balance in full: This card provides cashback gifts on each purchases, but those rewards can quickly be negated by interest charges if you carry a balance. Be sure to pay your balance in full every month to avoid interest charges and get the most out of your rewards.

- Check your spending habits: This card has a variety of features that can help individuals keep track of their spending, such as weekly and monthly spending summaries and alerts for unusual activity. Be sure to take advantage of these features to stay on top of your finances.

- Understand the rewards structure: The Apple Card offers different cashback percentages depending on the type of purchase. Be sure to understand the rewards structure so you can maximize your rewards. For example, you can earn and get 3% cashback on direct purchases with Apple, but only 1% cashback on purchases utilizing the physical card.

By following these tips and using this card wisely, you can take advantage of the rewards and benefits it offers and make the most of your money.

Final thoughts

We can all agree that the Apple Card can be a great choice for those who are already invested in the Apple ecosystem and wants a simple and easy-to-use credit card. However, this card may not be the perfect option for everyone. As with any financial decision, it’s essential to do your research and weigh the advantages and disadvantages carefully before making a decision.

Valentine’s Day: The 23+ best Valentine’s Day gifts in 2025 <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Valentine's Day is approaching, and it's time to find that perfect gift to express your love in 2025. </p>

Valentine’s Day: The 23+ best Valentine’s Day gifts in 2025 <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Valentine's Day is approaching, and it's time to find that perfect gift to express your love in 2025. </p>  AIibaba AI Qwen 2.5-Max: boost your advertising revenue <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The digital advertising landscape is transforming rapidly, and AIibaba AI Qwen 2.5-Max stands at the forefront of this revolution. </p>

AIibaba AI Qwen 2.5-Max: boost your advertising revenue <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The digital advertising landscape is transforming rapidly, and AIibaba AI Qwen 2.5-Max stands at the forefront of this revolution. </p>  AI-based entrepreneurship: The power to change the consumer consciousness <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> In the rapidly evolving landscape of technology, AI-based entrepreneurship stands out as a game-changer. </p>

AI-based entrepreneurship: The power to change the consumer consciousness <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> In the rapidly evolving landscape of technology, AI-based entrepreneurship stands out as a game-changer. </p>