If you are an U.S. citizen or just moved to USA, you will hear about credit history or credit score, but what does this actually means? Basically, credit is money borrowed, this money allows people to access goods and services that they can’t pay in cash. The money that was borrowed will be paid back later with interests. The credit score is a number that the loaners will use as reference when you apply for any kind of credit, like loans, credit cards and mortgages.

It is based on your credit score that the bank knows that you have a good credit history. If you have low or no credit score, you can get reject for loans, not get a job, be unable to buy a car or rent an apartment, or if you did not get rejected by the loan companies, you can end up with higher interest rates than people with good score.

The FICO score

The FICO score is a type of credit scoring model, and is commonly used by credit card companies to evaluate you credit history. The FICO is a data-based score method that determinates how responsible you are when it comes to credit, in other words, they will determinates if you will pay back the money you borrow or not, based on past experience.

The FICO score is divided in five categories: Poor, Fair, Good, Very Good and Exceptional. The higher your score on a better category you will be, the score goes from 300 to 850.

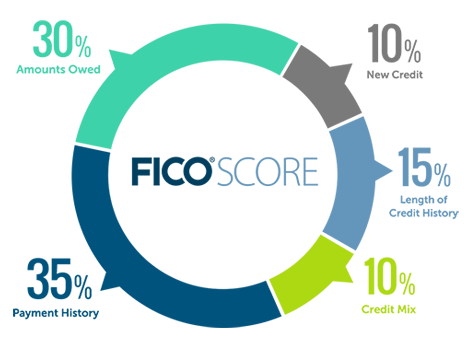

The Fico score is determinate based on the information of the three main credit bureaus in US, the main elements that accounts for the scoring are: new credit, credit mix, payment history, amounts owned and length of credit history.

The main elements of your score

- when you get a new loan or a new credit card, most banks will do a hard check on your credit history, if you have to many companies doing a check on your history, meaning you are requesting a lot of loans or cards, this can impact your score in a negative way.

- Payment History: this one is checking if you pay your bills and loans on time, if you are a good payer, you get good points on this.

- Amounts owned: calculates how much you own in relation to how much credit was given to you. If you have a loan of $20.000 and a balance of $4.000, you will have a 20% of utilization ratio. The lower your utilization ratio is, the better your score will be.

- Length of credit history: The longer you have a credit account the better your score will be.

- Credit mix: there a differents types of credit, having the same type of credit is not good, is better to have a mix of types of credits in your name.

Main types of credit

As we said before there are some different types of credit accounts, the three most common are: installment, open and revolving. You want to have at least two different types of credit on your report, to have a better score. These are the difference between them:

- Open: Open creditis the rarer type of credit account, it means an unsecured credit with no collateral attached to them, the are no interests and the borrower is allowed access credit repeatedly up to a specific maximum limit, but they have to pay the full balance each month. Example: charge cards.

- Revolving: this one allows you to borrow the money and pay it back over time with monthly payments. Normally this type of credit comes with monthly fees calculated based on your balance. Example: credit cards.

- Installment: comes in the form of a loan with a fixed loan amount, fixed payments and an established repayment schedule. You will get the full amount of your loan all at once, and will have a specific schedule to pay your debt. Example: mortgage loan.

What you can do to improve your credit history?

Raising your score will not be an easy task, but we are here to help you. First of all, you need to request your credit report to know how is your score, after that you can star improving it. There cannot be defaulted balances in your report, if you have some of these, you’ll have to deal with these before anything else.

After that you can star looking for credit cards and credit lines to add, there are a lot of cards in the market the helps you build your score with low or no fees. You can start by adding secured credit cards, to build up your credit file. The ideal utilization ratio for a good credit score is bellow 30%, try your best to get there.

Try to increase your limit on your credit accounts, the higher your limit, the better your score. Try not to use all of your limit, to keep your ratio low. Be sure to have at least two types of credit on your files, especially installment and revolving credit to get a better credit score.

We hope that with our help you will get a better understanding of your credit score and how to improve it.

Best Allowance and Chore App for Kids <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> As parents, we all know how challenging it can be to teach our children the value of money and how to manage it effectively. </p>

Best Allowance and Chore App for Kids <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> As parents, we all know how challenging it can be to teach our children the value of money and how to manage it effectively. </p>  Victory for Consumers as All Three Credit Bureaus Now Offer Weekly Free Report Access <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> In a victory for consumers everywhere, all three credit bureaus have announced that they will now offer free weekly credit reports. </p>

Victory for Consumers as All Three Credit Bureaus Now Offer Weekly Free Report Access <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> In a victory for consumers everywhere, all three credit bureaus have announced that they will now offer free weekly credit reports. </p>  Revolutionizing Comfort: The Best HVAC Software of 2024 <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> As technology advances, it's becoming increasingly more important to use software that can help streamline your business and keep you competitive. </p>

Revolutionizing Comfort: The Best HVAC Software of 2024 <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> As technology advances, it's becoming increasingly more important to use software that can help streamline your business and keep you competitive. </p>