Embarking on a journey with the Axis Atlas Credit Card opens the door to a world where travel and everyday spending are not just transactions, but opportunities for reward and luxury. In 2023, this card has been reimagined to cater more effectively to the needs of the modern consumer, especially those with a penchant for air travel.

It stands out in a crowded market of financial products, not just as a payment tool, but as a key to unlocking a series of exclusive benefits that align perfectly with your lifestyle and spending habits.

From a generous welcome bonus to tiered membership rewards and comprehensive airport services, the card is designed to enrich every aspect of your journey, whether you’re checking into a hotel, dining at a gourmet restaurant, or simply enjoying the convenience of contactless payments at your local grocery store.

Earning Rewards:

The Axis Bank Atlas Credit Card is a premium travel companion, offering a wealth of rewards and privileges tailored for the discerning traveler.

- Travel Expenditures: Earn 5 EDGE Miles for every ₹100 spent on direct bookings with airlines, hotels, and through the Axis Bank Travel Edge portal. This accelerated earning rate applies to cumulative travel spends up to ₹2,00,000 per month; beyond this threshold, the standard rate applies.

- Other Purchases: Receive 2 EDGE Miles for every ₹100 spent on all other eligible transactions, ensuring that everyday expenses contribute to your rewards balance.

Redeeming Rewards

Redeem your accumulated reward points for flights, hotel bookings, and more. But there’s more! You can also redeem your points for gift vouchers, premium merchandise, or statement credits. The redemption process is simple, flexible, and designed to give you maximum value for your points.

Benefits of Axis Atlas Credit Card

- Welcome benefit: Receive a welcome bonus of 2500 EDGE Miles when you make your first purchase with your ATLAS credit card within 37 days of receiving the card. This introductory offer is designed to give you a rewarding start as you begin to use your new credit card, enhancing your initial experience with valuable travel rewards right from the outset.

- Multiple airlines/hotel transfer partners with a good conversion ratio: What sets the Axis Atlas Credit Card apart from others is its multiple airline and hotel transfer partners, with a good conversion ratio. This means that you have the flexibility to transfer your reward points to a wide range of airlines and hotels, allowing you to choose the one that best suits your travel preferences. Whether you’re planning a dream vacation or a quick weekend getaway, these transfer partners will help you make the most of your rewards.

- Accelerated miles on travel spends: For avid travelers, the Axis Atlas Credit Card offers accelerated miles on travel spends. This means that every time you book flights, hotels, or even holiday packages, you’ll earn miles at a faster rate. This allows you to accumulate rewards quickly, bringing you closer to your travel goals with every trip you take.

- Priority Pass Membership: As an Axis Bank Atlas Credit Cardholder, gain access to Priority Pass, unlocking entry to thousands of airport lounges worldwide. Travel in style and make layovers a pleasure.

- Free lounge access: One of the standout perks of the Axis Atlas Credit Card is the free lounge access it provides. As a cardholder, you’ll have complimentary access to select domestic lounges, where you can relax, unwind, and enjoy a range of amenities before your flight. This luxury experience adds an extra touch of comfort and convenience to your travel journeys.

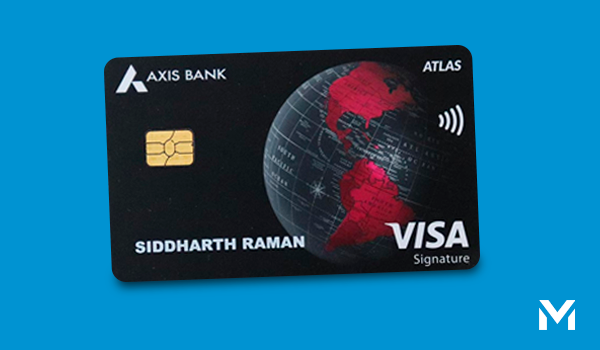

- Powered by VISA: Additionally, the Axis Atlas Credit Card is powered by VISA, one of the most widely accepted payment networks globally. This ensures that you can use your card at millions of merchants worldwide without any hassle or limitations, making it a reliable and convenient companion wherever you go.

- Global Acceptance: Use your card with ease anywhere in the world. Accepted across millions of merchants, the Axis Bank Atlas Credit Card ensures you’re never without financial support, no matter where you go.

- Zero Liability on Lost Card: Stay protected from fraudulent transactions in case of card loss. Report the loss immediately, and Axis Bank ensures that you’re not held liable for unauthorized use.

- Contactless Payment Technology: Enjoy fast, safe, and convenient transactions with the card’s contactless payment feature. Simply tap and pay for small purchases without the need to swipe or enter a PIN.

- Dedicated Customer Support: Access premium support anytime you need assistance. The dedicated helpline ensures that all your queries and concerns are resolved promptly, providing a seamless banking experience.

Qualification Requirements

To be eligible for the Axis Atlas Credit Card, applicants must meet specific criteria, typically involving age, income, and credit score requirements. These prerequisites ensure that the card is accessible to financially responsible individuals.

How to Apply

Applying for the Axis Atlas Credit Card is simple. Visit Axis Bank’s website or your nearest branch, fill out the application form, and submit the necessary documents. Once your application is approved, you can begin to enjoy the wide array of benefits offered by the card.

FAQs

What is the annual fee for the Axis Atlas Credit Card?

The annual fee INR Rs 5000 plus GST.

Can this card be used for international transactions?

Yes, the card is suitable for global use.

What is the reward rate for the card?

The reward rate varies from 1% to 10%, depending on the spend category and card tier.

How are the EDGE Miles redeemed?

EDGE Miles can be transferred to partner airlines and hotel loyalty programs, offering flexible redemption options.

HDFC Bank MoneyBack Plus Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unleash a world of rewards with HDFC Bank MoneyBack Plus Credit Card. Your everyday spending now comes with a silver lining of cashback! </p>

HDFC Bank MoneyBack Plus Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unleash a world of rewards with HDFC Bank MoneyBack Plus Credit Card. Your everyday spending now comes with a silver lining of cashback! </p>  Axis Bank Vistara Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the skies with Axis Bank Vistara Credit Card. Your journey towards endless rewards and exquisite travel experiences begins here! </p>

Axis Bank Vistara Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the skies with Axis Bank Vistara Credit Card. Your journey towards endless rewards and exquisite travel experiences begins here! </p>  AU Bank Vetta Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> AU Bank Vetta Credit Card: Where every transaction leads to rewards and every journey becomes more comfortable. </p>

AU Bank Vetta Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> AU Bank Vetta Credit Card: Where every transaction leads to rewards and every journey becomes more comfortable. </p>