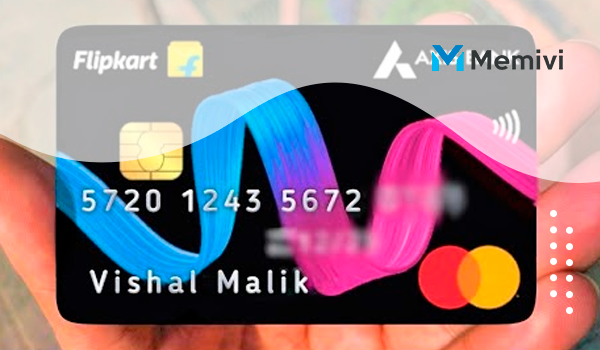

Imagine a world where your shopping not only satisfies your needs but also rewards every purchase. That’s precisely what the Flipkart Axis Bank Credit Card offers. Tailored for the savvy shopper, this credit card transforms your regular shopping experiences into a rewarding journey.

Whether you’re upgrading your wardrobe, buying the latest gadgets, or stocking up on home essentials, this card ensures that every rupee spent brings you closer to a host of benefits. Let’s dive into how this credit card can be your best shopping companion.

The Flipkart Axis Bank Credit Card is much more than a payment tool; it’s a passport to a world of exclusive benefits and rewards. Designed in partnership with one of India’s largest e-commerce platforms, this card focuses on maximizing your gains with every transaction.

From cashback to discounts, it’s packed with features that make it an ideal choice for both frequent Flipkart shoppers and those who appreciate the convenience of online shopping.

Earning Rewards

- 5% cash back on spending purchase: With this card, you can enjoy a whopping 5% cashback on all your spending purchases. Whether you’re buying groceries, electronics, or fashion essentials, every swipe will earn your attractive cashback rewards.

- 4% cash back on preferred merchants’ purchases: The Flipkart Axis Bank Credit Card offers an enticing 4% cashback on purchases made from preferred merchants. Imagine the joy of shopping at your favorite stores and being rewarded for it!

Redeeming rewards

The Flipkart Axis Bank Credit Card is an excellent choice for frequent shoppers on Flipkart and Myntra, providing significant cashback and a host of additional benefits to enhance your shopping experience.

The cashback earned is automatically credited to your credit card statement each month, effectively reducing your outstanding balance.

Benefits of Flipkart Axis Bank Credit Card

From earning generous rewards on Flipkart purchases to enjoying exclusive discounts and offers, the Benefits of Flipkart Axis Bank Credit Card are undeniable. Here are they:

- No limit on gaining cashback: Unlike other credit cards, there is no limit to the amount of cashback you can earn with the Flipkart Axis Bank Credit Card. The more you spend, the more you save, making every shopping experience a rewarding one.

- Connects people in local retail stores: This card not only connects you with online shopping on Flipkart but also with local retail stores. By using the Flipkart Axis Bank Credit Card, you can enjoy exclusive offers and discounts at partner stores, making your shopping experience even more delightful.

- 15% discount on food from partner restaurants: Foodies, rejoice! The Flipkart Axis Bank Credit Card offers a mouthwatering 20% discount on partner restaurants. Whether you’re dining out or ordering in, this card ensures that you savor delicious meals while saving money.

- 1.5% Cashback on All Other Spends: Receive 1.5% cashback on all other purchases, ensuring that every transaction contributes to your savings.

- Welcome Benefits Worth ₹1,100: Kickstart your journey with a ₹500 Flipkart gift voucher upon your first transaction within 30 days, and a 50% discount (up to ₹100) on your first Swiggy order.

- Complimentary Airport Lounge Access: Enjoy four complimentary domestic lounge visits per year (one per quarter), adding comfort to your travel experiences.

- Fuel Surcharge Waiver: Benefit from a 1% fuel surcharge waiver on transactions between ₹400 and ₹4,000, with a maximum waiver of ₹500 per month, making your fuel purchases more economical.

- Dining Discounts: Avail up to 20% discount at over 4,000 partner restaurants, enhancing your dining experiences with substantial savings.

- EMI Conversion Facility: Convert purchases above ₹2,500 into easy EMIs, providing flexibility in managing your expenses.

- Contactless Payments: Experience the convenience of contactless payments for quick and secure transactions, streamlining your shopping process.

- Annual Fee Waiver: Enjoy an annual fee waiver upon spending ₹2 lakh in the preceding year, making the card more cost-effective.

Qualification Requirements

To apply for the Flipkart Axis Bank Credit Card, you must meet certain criteria. These include a minimum age of 18 years and a stable source of income, ensuring you can manage credit responsibly.

The bank also considers your credit history and score, with a higher score increasing your chances of approval. It’s open to both salaried and self-employed individuals, making it accessible to a wide range of customers.

How to Apply for the Flipkart Axis Bank Credit Card

- Visit the Axis Bank Website or Branch: Begin by visiting the official Axis Bank website or your nearest Axis Bank branch.

- Find the Credit Card Section: On the website, navigate to the credit cards section and select the Flipkart Axis Bank Credit Card.

- Fill Out the Application Form: Complete the online application form by entering your personal and financial information such as your name, address, income, and employment details.

- Submit Necessary Documents: You will need to upload or provide copies of certain documents for identity, address, and income verification. This typically includes your ID proof (like Aadhar or PAN card), address proof (such as a utility bill or rental agreement), and income proof (like salary slips or tax returns).

- Wait for Approval: After submission, your application will undergo a verification process. Axis Bank will check your credit history and other details.

- Receive Your Card: Once your application is approved, the bank will dispatch the Flipkart Axis Bank Credit Card to your registered address.

Frequently Asked Questions

What is the annual fee for this card?

The card comes with a nominal annual fee, often waived off on meeting certain spend criteria.

Can I use this card internationally?

Yes, it’s enabled for international use, subject to standard charges.

Are there any cashback limits?

Cashback earned may have a monthly cap, varying based on card usage.

Is this card good for offline purchases?

Absolutely, it offers rewards and benefits on offline purchases as well.

HDFC Bank MoneyBack Plus Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unleash a world of rewards with HDFC Bank MoneyBack Plus Credit Card. Your everyday spending now comes with a silver lining of cashback! </p>

HDFC Bank MoneyBack Plus Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unleash a world of rewards with HDFC Bank MoneyBack Plus Credit Card. Your everyday spending now comes with a silver lining of cashback! </p>  Axis Bank Vistara Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the skies with Axis Bank Vistara Credit Card. Your journey towards endless rewards and exquisite travel experiences begins here! </p>

Axis Bank Vistara Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Unlock the skies with Axis Bank Vistara Credit Card. Your journey towards endless rewards and exquisite travel experiences begins here! </p>  AU Bank Vetta Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> AU Bank Vetta Credit Card: Where every transaction leads to rewards and every journey becomes more comfortable. </p>

AU Bank Vetta Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> AU Bank Vetta Credit Card: Where every transaction leads to rewards and every journey becomes more comfortable. </p>