The Discover it Student Cash Back card is a game-changer for students looking to earn rewards while building their credit. What sets this card apart is its unique cash back match feature at the end of the first year. This means all the cash back you’ve earned is doubled automatically, giving you even more value for your spending.

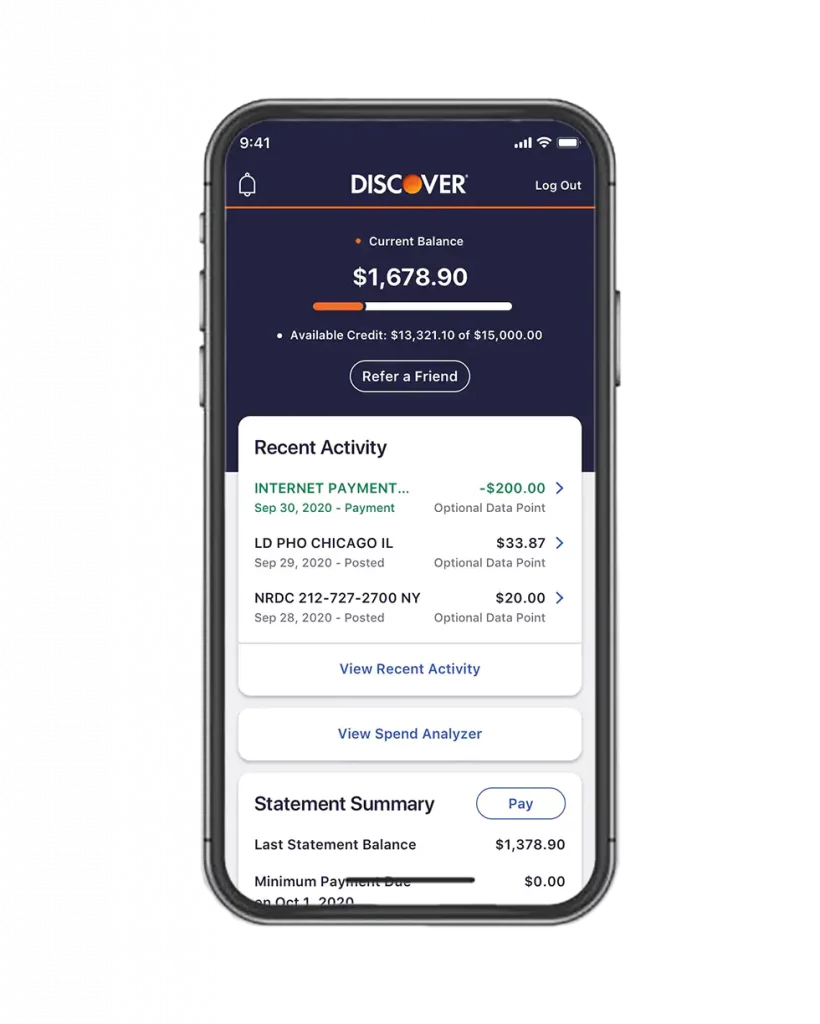

For students, the benefits don’t stop there. The Discover it Student Cash Back card also provides free access to your FICO credit score, empowering you to monitor your credit journey closely. Plus, there’s no annual fee, making it easy for students to manage without adding extra costs. The card’s user-friendly mobile app and customer service ensure that students can navigate their finances with confidence.

If you’re a student looking for a rewarding credit card that aligns with your lifestyle and budget, the Discover it Student Cash Back card is definitely worth considering.

Everyday Benefits

The ‘Discover it Student Cash Back’ shines in daily life. Did you know you can earn rewards on every purchase you make? Plus, this card offers cash back in rotating categories each quarter. Whether you’re buying textbooks at the bookstore or filling up at the gas station, you’re always earning rewards.

Another unique advantage is the ‘Good Grade Reward’ program. For each academic year you maintain a high GPA, you receive an additional bonus. Studying and saving has never been so rewarding!

5% Cash Back in Rotating Categories

Every quarter, the “Discover it Student Cash Back” card offers a unique opportunity to earn 5% cash Every quarter, the ‘Discover it Student Cash Back’ card presents a fantastic opportunity to earn 5% cash back in rotating categories. These categories can vary from gas stations to grocery stores, catering to different spending habits and needs.

To make the most of this benefit, stay updated on the announced categories each quarter and plan your purchases accordingly. By aligning your spending with these categories, you can significantly increase your cash back earnings, up to the specified quarterly limit.

Good Grade Reward

The Good Grade Reward is a distinctive feature of the ‘Discover it Student Cash Back’ card, aimed at promoting academic excellence. Students who maintain a GPA of 3.0 or higher qualify for an annual cash back bonus. This incentive not only rewards hard work in academics but also provides additional financial support.

To benefit from this feature, simply submit your grades to Discover at the end of each school year. It’s a straightforward way to earn rewards for your academic achievements while effectively managing your finances.

No Annual Fee

This card is particularly student-friendly because it doesn’t have an annual fee. This feature makes it an economical choice for students who are often on a tight budget. Without the concern of an annual fee, you can concentrate on using the card for essential purchases and building your credit history. It’s ideal for those new to credit cards, as it reduces the cost of having a credit card while still providing substantial rewards.

Account Freeze Feature

The Account Freeze feature adds an extra layer of security and control. If you misplace your card or suspect unauthorized use, simply use the Discover app to immediately freeze your account. Freezing your account prevents new purchases, cash advances, and balance transfers, providing peace of mind. Reactivating your card is just as easy once you locate it or address your concerns. This feature is a valuable tool for proactive and secure account management.

1% Cash Back on All Other Purchases

In addition to earning 5% cash back on rotating categories, the card consistently rewards you with 1% cash back on all other purchases. This means every transaction contributes to your cash back total. Whether it’s daily expenses or larger purchases, every cent spent helps accumulate rewards. To maximize this benefit, use your Discover card for regular purchases like utilities, online shopping, and dining out. It’s an effortless way to build rewards over time.

0% Intro APR for Six Months

New cardholders enjoy a 0% introductory APR on purchases for the first six months. This feature is especially beneficial for making larger purchases or managing expenses at the beginning of the academic year. By leveraging this interest-free period, you can spread the cost of significant items without accruing interest, making budgeting and balance repayment easier. Remember to plan your repayment strategy before the introductory period ends to avoid interest charges.

Access Requirements

To get this card, you must be over 18, a college student, and have a clean credit history. No minimum income is required, making it accessible to many students.

How to Apply

Here’s a shorter step-by-step guide on how to apply for the Discover it Student Cash Back card:

- Visit Discover’s Website.

- Find the Student Credit Cards Section.

- Select the Discover it Student Cash Back Card.

- Click ‘Apply Now’.

- Review and submit Your Application.

- Wait for Approval.

- Receive and Activate Your Card.

Applying for the Discover it Student Cash Back card is quick and easy through Discover’s website. Ensure you have all necessary information on hand before starting your application.

FAQs (Frequently Asked Questions)

What is the APR after the introductory period?

It varies based on your credit score.

Is there a cash back limit?

No limit on the 1% cash back.

Can I use the card outside the U.S.?

Yes, with no additional fees.

What happens if I pay late?

Discover offers a lenient policy for the first late payment.

HSBC Elite Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Each benefit of the HSBC Elite Credit Card is designed to enhance your lifestyle and provide exceptional value, ensuring you experience the best in luxury and convenience. </p>

HSBC Elite Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Each benefit of the HSBC Elite Credit Card is designed to enhance your lifestyle and provide exceptional value, ensuring you experience the best in luxury and convenience. </p>  Total Visa Rewards Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Are you ready to elevate your spending to a whole new level? The Total Visa Rewards card offers an exciting opportunity to earn rewards while managing your finances responsibly. </p>

Total Visa Rewards Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Are you ready to elevate your spending to a whole new level? The Total Visa Rewards card offers an exciting opportunity to earn rewards while managing your finances responsibly. </p>  Kohl’s Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Exclusive discounts, rewards, and perks meticulously crafted to elevate your shopping experience to new heights at Kohl’s. </p>

Kohl’s Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Exclusive discounts, rewards, and perks meticulously crafted to elevate your shopping experience to new heights at Kohl’s. </p>