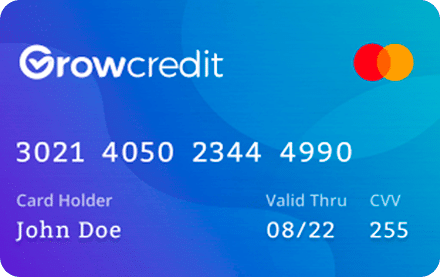

Imagine a credit card that revolutionizes the way you build credit, offering a seamless and innovative approach to establishing positive credit history. This card is designed to provide individuals with a credit-building tool that doesn’t require a traditional credit check or impact your credit score

It operates on a membership model that allows you to use a virtual card for qualifying expenses and gradually build credit over time. With a focus on accessibility and convenience, this card aims to empower individuals to take control of their credit journey and achieve financial goals without the barriers of traditional credit requirements.

Unlock a new era of credit-building with a cutting-edge card that transforms everyday expenses into credit-building opportunities.

Pros and Cons

Pros:

- Approval is based on other qualifying factors, not a traditional credit check.

- Allows you to build credit history with qualifying expenses reported to credit bureaus.

- Use a virtual card for eligible expenses, promoting responsible credit use.

- Pay a monthly membership fee to access credit-building features.

- Offers a streamlined approach to building credit without the need for a physical credit card.

Cons:

- Requires payment of a monthly fee to access credit-building services.

- The credit limit may be limited based on membership terms and usage.

For whom was this credit card made for?

This credit card is crafted for individuals who may have limited or no credit history and are looking for a unique and accessible way to build credit. It’s ideal for those who have faced challenges with traditional credit approval processes or are seeking an alternative credit-building solution.

The card’s innovative approach, which operates on a membership model and utilizes a virtual card, makes it suitable for individuals who value convenience and flexibility in managing their credit. Additionally, this card caters to those who prioritize credit-building and are willing to invest in a monthly membership fee to achieve their financial goals.

Why do we like this credit card?

We like this credit card because it’s an unconventional but effective method to build credit. The absence of a traditional credit check and the use of a virtual card for qualifying expenses offer a hassle-free way to establish a positive credit history.

The membership model provides flexibility and accessibility, allowing you to start building credit without the constraints of a typical credit card application process. Furthermore, this card promotes responsible credit use and financial discipline, encouraging you to make qualifying purchases that contribute to building your credit profile.

If you’re looking for a forward-thinking credit-building solution that aligns with your financial goals and preferences, this card offers a refreshing alternative to traditional credit cards.

HSBC Elite Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Each benefit of the HSBC Elite Credit Card is designed to enhance your lifestyle and provide exceptional value, ensuring you experience the best in luxury and convenience. </p>

HSBC Elite Credit Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Each benefit of the HSBC Elite Credit Card is designed to enhance your lifestyle and provide exceptional value, ensuring you experience the best in luxury and convenience. </p>  Total Visa Rewards Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Are you ready to elevate your spending to a whole new level? The Total Visa Rewards card offers an exciting opportunity to earn rewards while managing your finances responsibly. </p>

Total Visa Rewards Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Are you ready to elevate your spending to a whole new level? The Total Visa Rewards card offers an exciting opportunity to earn rewards while managing your finances responsibly. </p>  Kohl’s Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Exclusive discounts, rewards, and perks meticulously crafted to elevate your shopping experience to new heights at Kohl’s. </p>

Kohl’s Card Review <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Exclusive discounts, rewards, and perks meticulously crafted to elevate your shopping experience to new heights at Kohl’s. </p>