Credit is a very important part of a person’s life. Without it, you’d have to rely on a friend, family member, or a loan shark. When you have credit, you can start a business, buy a house, get a loan, and more. Having good credit will also help you because it will help you to get better interest rates and lower down payment prices on loans. Credit is important whether you are an individual or a business. In order to get good credit, you need to pay your debts on time and only take on what you can handle.

Moreover, credit is a type of financial asset, which means that it is a medium of exchange that can be used to purchase goods or services. In order to live a good life, it is important to have good credit.

To explain what credit is, credit is a promise to pay back a debt in the future, and it is a type of financial loan. The borrower gives a lender the right to receive payment after a certain time. Credit has been around for thousands of years, and it has changed over time. The earliest credit was based on debt of goods, then it was based on debt of wine and eventually it was credit cards.

There are many different types of credit instruments including a credit card, a mortgage, a car loan, a personal loan, and more. Credit is an asset and a liability at the same time – because you have to have a good Credit Utilization Ratio to assign the best value you can get.

What is a Credit Utilization Ratio?

A credit utilization ratio is the ratio of credit balances to the credit limit. It shows the percentage of a credit account’s available credit that has been used, which can help to determine the riskiness of the account. A credit utilization ratio of less than 30% is considered safe and ideal. A credit utilization ratio of 30% to 50% is considered moderate, while anything above 50% is considered high. The lower the ratio, the better the company or individual is at managing their debt. The higher the ratio, the more likely the company or individual is to experience financial difficulties.

Credit utilization ratio is used by lenders to determine the company’s credit worthiness. Companies or individuals with a high credit utilization ratio are considered risky and are more likely to be turned down for loans.

How to calculate Credit Utilization Ratio?

Credit utilization ratio is the ratio of the amount of credit extended to the amount of credit that is drawn upon, or the amount of credit used. It is a measure of the product’s debt-to-equity and is calculated by dividing the balance of the revolving credit line by the total amount of credit extended.

Furthermore, this measurement is a key metric in the credit underwriting process. Below is a great example on how you can calculate your credit utilization ratio:

$30,000 as an outstanding balance

$100,000 as a total credit limit

($30,000 ÷ $100,000 x 100), which then gives you a 30% credit utilization ratio.

A good credit utilization ratio is around 15-30%. This is the ideal ratio to keep your credit in a healthy state and to avoid any problems. Because when a business or individual has too much debt, it can be a problem. This could lead to bankruptcy, which would be devastating, or it could lead to a loss of your business or job.

Ways to keep your Credit Utilization Ration Low

When you’re taking out a loan, it’s always worth knowing how to keep your utilization rate low. This will reduce the interest you pay and help your finances. However, this can be difficult. That’s where this blog post comes in. It’s going to teach you five key ways to keep your utilization rates low. By utilizing these methods, you’ll be able to pay off your loans quickly, which is good for your wallet.

- Pay all your credit purchases within the same day

When it comes to credit cards, it’s important that you make sure you’re not spending too much of your available credit. If you’re not careful, you might end up with a high credit utilization ratio. If your credit utilization ratio is high, it could have a negative impact on your credit score. In order to keep your credit utilization ratio low, it’s important that you pay off your credit card bill within the same day. For example, if you have a balance of $1,000 to be paid on a credit card, you can pay off the card in one day by making the minimum payment.

- Make multiple payments in the same month

Some people have high credit utilization ratios on their credit cards, which is defined as the percentage of the available credit limit that’s used. If your ratio is too high, credit card companies will likely close your account, and that could lead to a lot of trouble. The key to lowering your ratio is making multiple payments in the same month. This will make your credit utilization ratio lower by making it look as though you’re making regular payments. This is important because if you’re making multiple payments in the same month, the credit card company will likely extend your credit limit.

- Try to ask for an increased credit card limit

Credit cards are a great way to manage how much you spend. However, if you have a high credit card limit and are trying to keep your credit utilization ratio low, it is time to think about asking for an increased credit limit. When you ask for an increased credit limit, the bank is going to weigh the benefits of approving your request with the potential loss of revenue. If you have a good track record, you should be able to get the increased credit limit that you need.

- Have multiple credit cards

Credit utilization is the total amount of revolving credit you currently have outstanding. It includes both the credit cards you have, as well as the amount of credit you took out on all your other accounts. When you have a high credit utilization ratio, it can affect your credit score in a negative way. To ensure you keep your credit utilization low, you should consider having multiple credit cards. This allows you to pay off your credit card in full before the interest rates increase.

- Keep your credit accounts open

Keeping your credit accounts open is a smart strategy for keeping your Credit Utilization Ration low. It also prevents identity fraud, which is a major problem for consumers. If you want to keep your credit utilization low, you need to be careful with how you use your credit cards. If you’re using your credit cards to buy things you don’t need, you will be charged interest as well as a finance charge. Interest and finance charges on your credit card can really add up, so make sure you’re using your credit cards for what they’re meant for.

How credit utilization ratio affects credit history?

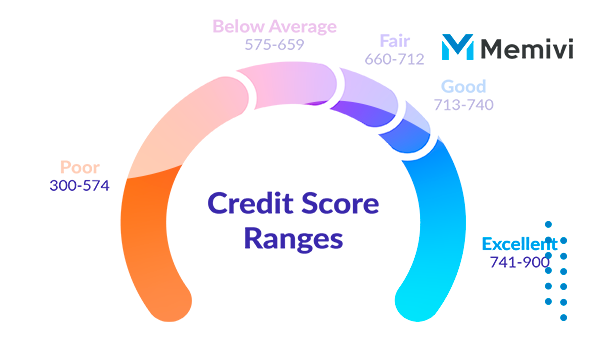

Credit utilization ratio is one of the most important factors that can have a significant effect on your credit history. Credit utilization ratio is the amount of credit card debt you have to the amount of available credit on your card. This ratio is calculated by dividing your credit card bill by the available credit on your credit card. The maxim of credit utilization is that it should be under 30%. The higher this ratio is, the more likely it is that your account will be deemed as a high-risk account. And if you are considered to have a high-risk account, no lenders or bank is going to approve any loan application.

Conclusion

The credit utilization ratio is used determine how much you can borrow. If your ratio is too high, your credit score may take a hit, which would slow down your ability to borrow money. This article provides some helpful tips to lower your credit utilization ratio. If you are interested in learning more, we would love for you to read our blog on what is the ideal credit utilization ratio!

U.S. tariffs: Government of Canada announces next steps in its response plan <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The Government of Canada is taking decisive measures in response to the unjustified U.S. tariffs that have affected trade and economy. </p>

U.S. tariffs: Government of Canada announces next steps in its response plan <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> The Government of Canada is taking decisive measures in response to the unjustified U.S. tariffs that have affected trade and economy. </p>  Canada Tariff: Trump confirms 25% tariff for the country <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Canada tariff policies significantly influence global commerce and economic trends. Understanding these tariffs is essential for businesses and policymakers alike. </p>

Canada Tariff: Trump confirms 25% tariff for the country <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Canada tariff policies significantly influence global commerce and economic trends. Understanding these tariffs is essential for businesses and policymakers alike. </p>  Everything You Need to Know about Credit Reports <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Learn how credit reporting works and how to use it to your advantage and what the benefits are for your Credit Score. Learn more. </p>

Everything You Need to Know about Credit Reports <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Learn how credit reporting works and how to use it to your advantage and what the benefits are for your Credit Score. Learn more. </p>